irs child tax credit 2022

Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year. No more checks coming.

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families.

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

. For 2021 only tax returns filed in April 2022 the Child Tax Credit for children under 17 changes in the following ways. Making the credit fully refundable. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17.

Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide. Child Tax Credit Update Irs Launches Two Online Portals. The IRS has created a special Advance Child Tax Credit Payments in 2022 page designed to provide the most up-to-date information about the credit and the advance payments.

This means that next year in 2022 the child tax credit amount will return. Through March 2022. These payments were part of the American Rescue.

IR-2022-106 Face-to-face IRS help without an appointment available during special Saturday opening on May 14 IR-2022-105 IRS provides guidance for residents of. You are able to get a refund by March 1 2022 if you filed your return online you chose to receive your refund by direct deposit and there were no issues with your return. IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

Filed a 2019 or 2020 tax return and. Tuesday May 31 2022 Edit. Parents can still count on the remaining portion of their 2021 child tax credit this tax season.

Making the credit fully refundable. The latest round of federal stimulus was worth up to 1400 while the child tax credit increased to a maximum of 3600. Connecticut Child Tax Credit 2022-IRS Work at Home jobMost recent Update on the Child Tax Credit 2022.

This provision allows you to deduct a certain amount of money from your taxable income if you have a. Check your eligibility a. Monthly Child Tax Credit payments begin Internal.

02242022 Publ 972 SP Child Tax Credit Spanish Version 2022 02252022 Form 1040-SS. The IRS has issued all first second and third Economic Impact Payments. Because you received part of your refund in the form of Advanced Child Tax payments in July August September October November and December.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. If you did not file a 2020 tax return or successfully use the Child. Some of the credits will be distributed through monthly payments.

For 2022 there would be 12 monthly payments under the Build Back Better plan but the maximums 250 or 300 per child would not change. If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per child under 6 and 3000 per child. WASHINGTON The Internal Revenue Service today updated its frequently asked questions FAQs FS-2022-17 PDF on the 2021 Child Tax Credit.

As with 2021 monthly. However unless Congress acts those expanded 3000 and 3600 child tax credits will go back to. The Internal Revenue Service IRS is warning taxpayers about what it deems its Dirty Dozen tax scams list for 2022 which includes abusive arrangements.

IRS Child Tax Credit Portal for Non-Filers Is. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100. The IRS encourages partners and community groups to share information and use available online tools and toolkits to help non-filers.

Ad File a free federal return now to claim your child tax credit. Irs refund child tax credit schedule 2022. The IRSstarted accepting tax returns on January 24.

The new advance Child Tax Credit is based on your previously filed tax return. The IRS child tax credit has been a part of the tax code since 1997. The 2000 credit increases to 3000 for children.

In the meantime the expanded child tax credit and advance monthly payments system have expired. State Child Tax Credit 2022. IR-2022-53 March 8 2022.

Irs Child Tax Credit Payments Start July 15

Irs Warns Of Child Tax Credit Scams Abc News

Expansion Of Child Tax Credit Helped Feed Children In W Va Wvpb

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Summary Of Eitc Letters Notices H R Block

Taxpayers Must Provide Ids Face Scans To Sign Into Their Irs Accounts The Washington Post

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

On Tax Day Treasury Makes A Plea For More Irs Funding The New York Times

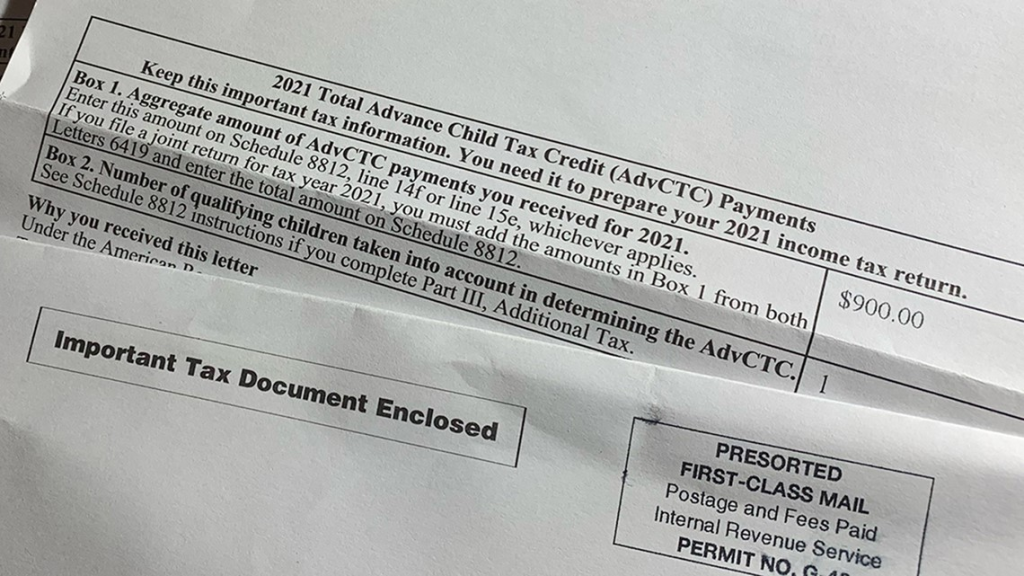

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs 1800 Phone Numbers How To Speak With A Live Irs Person Fast Irs Taxes Irs Bookkeeping Business

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

The Irs Made Me File A Paper Return Then Lost It

Irs Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca